Aon/Healthcare Exchange

October 26, 2014

Many of you have asked “What happens if I turn 65 after the first of the year in 2015?”

The way it works is that during the year in which a retiree turns 65, they will have both the AT&T Pre-65 Group Health plan AND the Exchange in 2015. They would still sign up for their Pre-65 benefits through the AT&T Benefits Center for the timeframe up until they become Medicare eligible. Just before they turn 65, they will need to enroll through the Exchange for the remainder of that year and beyond.

• Approximately 120 days before their birthday the retiree will receive a Medicare attainment letter from the AT&T Benefits Center advising them that their AT&T group coverage will be ending.

• Up to 6 months in advance of their 65th birthday, they would also receive correspondence from Medicare giving them information about Medicare enrollment. They should take action right away to enroll ensure they are enrolled in Medicare A & B. The enrollment period for those who turn age 65 is the 90 days prior to their birth month, the month of their birth and 3 months following their birthday (3-1-3).

• About 90 days before their birth month they will receive an education packet, including a prescheduled appointment date and time, from the Aon Retiree Health Exchange to gear them up for the transition. They will want to ensure that they have selected and enrolled in a plan before the first day of their birth month to ensure they have secured the coverage they need.

• Medicare becomes effective the 1st day of the individuals birth month. But note that if the retiree’s birthday is on the first of the month, they become Medicare eligible one month earlier.

It is each retiree’s responsibility to sign up for Medicare part A and B by their 65th birthday to ensure they experience no gap in coverage. The retiree’s coverage with AT&T will end the last day of the month before their 65th birthday. The coverage elected through the Exchange will be effective the following day (1st day of the month in which they are born).

Before you ask more questions about what is going on with ATT/AON please read the attached. Most of your questions will be answered.

ATT Retiree Issues October 16, 2014

Information for AT&T Retirees Moving to the Aon Exchange

Please read this before posting questions to the group, it answers most of the questions.

This is a 3 part list that addresses the most important issues concerning the move to the Aon healthcare exchange. I update this information to keep it current. This document supersedes and replaces all previous documents.

Answers to the most common questions:

- This information applies to Plan year 2015 only unless it specifically states otherwise.

- To move to the Aon exchange:

- You must be retired after 1/1/1992 (not grandfathered), and before 9/2013. (For SNET those who are not grandfathered retired after 1/2/92).

- You must be Age 65 on or before 2/1/2015,

- You must be enrolled in Medicare A & B,

- You must be an AT&T retiree or spouse.

- Otherwise you stay on the present plan. If you do NOT meet these requirements you can stop reading here because this information does NOT apply to you.

- Contact information:

- AT&T landing page at the Aon exchange https://www.aonhewittnavigators.com/att

- Can you qualify for a Special Needs Program? http://www.medicare.gov/sign-up-change-plans/medicare-health-plans/medicare-advantage-plans/special-needs-plans-faq.html

- Medicare telephone 1-800-MEDICARE (1-800-633-4227)

- Medicare Plan Finder https://medicare.gov/find-a-plan/questions/home.aspx

- Medicare Insurance Helpline:

- Toll free: 1-866-391-7734

- Email: NGHS@MedicareCompareUSA.com

- Contact Social Security at www.ssa.gov or 1-800-772-1213 http://www.socialsecurity.gov/

- My Retiree health Exchange http://myretireehealthexchange.com/

- State Health Insurance Assistance Program (SHIP) use this website to locate contact information for your state https://shipnpr.shiptalk.org/shipprofile.aspx

- An out of network source to compare Part C and Part D plans. http://www.healthpocket.com/medicare

- These are not affected by the move to Aon and continue as usual, for that reason they are not discussed further in this document.

- CarePlus (AT&T Benefits at 1-877-722-0020),

- Life Insurance Benefit (AT&T Benefits at 1-877-722-0020),

- Pension Death Benefit (Fidelity at 1-800-416-2363).

- If you have a preexisting condition Medigaps are Guaranteed Issue in 2015 and Guaranteed Renewable in 2016 and beyond. Because our company plan is ending you have the Right to Buy Medigap Plan A, B, C, F, K, or L.

- Medigap Plan F is the best plan they sell but is higher premiums. There is also a Plan F High Deductible that requires that you pay $2,140 before the plan pays anything–so it is not cheaper if you have health problems. I do not recommend the Plan F HD.

- Plans G & N require medical underwriting the first year. However, all Medigaps are Guaranteed Renewable. Plan G can save you money if you are in good health for the last 5 years.

- With Medigaps, Advantage, and Part D plans you do not need to enroll every year to continue coverage. If you do nothing they stay the same as long as the company continues to offer that plan. If the company drops the plan you will be offered another plan with the same coverage. Changes in enrollment i.e. you decide to change to a different plan–will expose you to medical underwriting. Buy a plan and keep it year after year and make payments on time.

- Part D Rx drug plans should be reviewed every year. The drug formularies change and it is possible that you may get a better price by changing plans. There are no penalties or restrictions for changing during open enrollment.

- Advantage Plans may have a $0 or low premium but are expensive to use and have high out of pocket limits at $5,900 or $6,700.

- MoO and BCBS have a reputation of having the highest rate increases; once you are locked in you can’t get another plan without qualifying through medical underwriting. Be wary of low prices they may be low balling. I have copies of three MoO letters showing a 40% rate hike in one year. On 5/11/11 $164.41 to $194.00, on 1/11/12 $194 to $202.60, and on 5/11/12 $202.60 to $232.99.

- Our Special Enrollment Period is 10/1/2014 to 12/31/2014. According to all of the Medicare rules anybody losing their creditable coverage has 2 full months AFTER their coverage ends to get a new plan–that would be the end of February. However, AON has stated that the plan needs to be in place by 12/31/14 to get the HRA – this is very confusing. I believe we are stuck with the 12/31/2014 deadline imposed by the SEP.

- Medigap Plans do not have Rx drug coverage so you will need to buy a Part D PDP (Rx Drug Plan). In the files section of this group is a document that explains how to buy a Part D, follow that process.

- Medicare Part B in some cases covers drugs, if you have an expensive drug you have used for an extended period check to see if it is covered.

- If you buy a Medicare Advantage HMO, POS, or PPO plan you will NOT be able to enroll in a standalone Part D PDP. Be sure your insurance coverage includes Rx drug coverage BEFORE you enroll.

- If you have VA coverage you may not need additional Part D Rx drug coverage, discuss this or other drug coverage with your Aon rep.

- Most Medicare Rx drug plans have a doughnut hole where you pay higher costs for out of pocket until a limit is reached. For Part D Plan Year 2015 the following applies:

Deductible $320.00 Initial Coverage Limit* $2,960.00 (*Doughnut hole begins) Out-of-Pocket Threshold** $4,700.00 (**Doughnut hole ends, CC begins) Total Covered Part D Drug Spending before Catastrophic Coverage*** $6,680.00 (***This includes your costs and the plans costs) - Catastrophic Coverage – After out of pocket costs exceed the doughnut hole you pay a small percentage for your drugs. AT&T will provide a CCHRA to pay your cost which is about 5% for the next $100,000 of Rx drug costs.

- Dental, Vision, and Long Term Care coverage are sold separately, it is optional.

- Medigap Plans are accepted wherever Medicare is accepted so you can keep your doctor if they accept Medicare now, big exception, some companies offer Medigap SELECT Plans which provide coverage only within a defined network of providers. Before you purchase SELECT make sure your hospital is included in the plans’ network.

- Advantage plans are HMO/PPO with network providers; if your doctor is not in their network HMO won’t pay. With PPO they will pay but it will be what they pay in network and you will have to pay any excess charges.

- To get an idea of coverage and prices off of the Aon exchange you can use the Medicare.gov Plan Finder at https://www.medicare.gov/find-a-plan/questions/home.aspx for finding plans in your area. You can also use insurer’s websites to find plans and don’t be bashful about asking an insurer questions.

- According to Aon all health plan carriers are required to sell an individual policy at the same price regardless of the broker/seller. If that is true a plans price will be equal on or off of the exchange. In my experience they don’t always match.

- When selecting a plan keep in mind that the Part A deductible is $1,216 (for 2014) and that it can be reset up to 5 times, meaning if you are in and out of the hospital multiple times you may have to pay the deductible each time.

- Retirees get a HRA with $2,700 and spouses get $1,500. The money can be combined and used by either to pay for eligible medical and drug premiums and out of pocket costs. At the end of the year any money left rolls over to the next year. If both are retirees they each get $2,700 in their HRA, not a combined HRA but each has access to the others funds.

- To get an HRA you must buy at least one Plan–a Medicare Advantage Plan, OR Medigap Plan, OR Part D Rx drug Plan–through the Aon exchange.

- You must continue paying the Part B premium. You will no longer receive a subsidy; it is included in the HRA. January 2015 your pension check will decrease by the amount of the subsidy.

- If you are now paying for healthcare through a deduction from your pension check that payment will end 12/31/2014, your pension check will increase by that amount.

- You can request auto payment of premiums and auto reimbursement for plans you buy on the Aon exchange. If you use auto payment of premiums make certain that a payment is not missed as it will open the door for the insurer to drop you and you will most likely have to pass medical underwriting to get coverage.

- There are two calls with Aon which you must confirm and complete. if you are not ready to enroll on the 2nd call you can reschedule or schedule a 3rd call.

- If you are in the group moving to the Aon exchange and you do nothing, come 1/1/2015 you will NOT have healthcare and Rx drug coverage.

- If you are already on an Advantage Plan in 2014, then keeping it in 2015 is not an issue and plan rules prevail. If you are new to Advantage Plans then Medicare Advantage Plan rules prevail.

- If you have limited income and assets, you may be eligible for the Extra Help program to pay your premiums and drug costs. Contact Social Security at www.ssa.gov or 1-800-772-1213 for more info.

- You will receive a Creditable Coverage letter in the fall, showing that you have coverage ending this year. Do NOT lose that letter.

How do you decide which plan is best for you?

- Learn all you can about the Advantage Plans and Medigap Plans A, B, C, F, G, K, L, and N.

- Contact your state SHIP.

- Call the individual insurance companies selling those plans.

- Call independent insurance reps to find competitive prices, and ask questions.

- Make a list of plus and minus points for the plans you are considering.

- Total the costs for each plan. Be sure to include the premiums and drug costs for a Part D Plan if it is not included in the plan.

- Know what the out of pocket limits are for the plans you are considering.

- Ask questions on the ATT Retiree Issues group and read other retirees’ questions and answers.

- Make the decision based on what you feel comfortable with.

The government thinks that Medigap Plans F and C are too good. They tried to get them changed to add some pain when they are used. Plan F pays all cost sharing including, deductibles, copays, coinsurance, and excess charges (costs above the Medicare limits).Plan C pays all deductibles, copays, and coinsurance.

I am told by independent agents that Medigap Plan G will save you a lot of money if you can pass the initial medical underwriting. It is guaranteed renewable.

Some healthcare insurance insiders say that retirees tend to overspend on Medigap healthcare insurance by buying Plan F. They recommend Plan L for most retirees. Here are my thoughts on Plans F & L:

- Medigap Plans K and L, after you meet your out of pocket yearly limit (K=$4,940 in 2014, L=$2,470 in 2014) and your yearly Part B deductible ($147 in 2014), the Medigap plan pays 100% of covered services for the rest of the calendar year. My premium costs for Humana Medicare Supplement: Plan L would be $1,586.40. The true out of pocket total is $4,302.40.

- Most Part D Prescription Drug Plans have an out of pocket limit of $4,550 in 2014. That includes the $310 deductible for 2014. For me Express Scripts Medicare (PDP) – Value Plan D the premiums would be $362.40. That is a true out of pocket total of $4,912.40.

- Plan F has no official out of pocket maximum but in reality it only has the premiums costs as it has no deductible and pays everything; copays, coinsurance, deductibles, and excess charges. For Omaha Insurance Company: Plan F the premiums would cost me $1,896.24.

- If you maxed out on Plan L and Part D the true out of pocket limit would be a combined $9,214.98. That does include the costs of the premiums.

- If you maxed out on Plan F and Part D the out of pocket limit including the premiums would be $6,808.64.

- If you had a healthy year with no expenses Plan L and part D would cost you $1,948.80, Plan F and Part D would cost you $2,258.64.

Is Plan L a good choice for you?

October 6, 2014

Q. If the spouse is not using AT&T medical today (many retirees opted to put their spouse on a separate plan finding it was more reasonable), will the spouse still qualify for “guaranteed issuance” for this enrollment period.

A. For retirees who are already enrolled in the individual marketplace (have left the AT&T plan and are not enrolled in another group plan of some kind), the special enrollment period does not apply, which means guaranteed issue opportunities are not available to them. Also, Medicare will not allow us to enroll a person into the same plan they already have. If we did, the enrollment would be rejected. In these cases, staying put in the current Medigap plan (assuming it still works for you) and enrolling in a new PDP is the right approach to triggering the HRA.

Q. Is it possible to allow the participant to change plans in the first 12 months without any underwriting.

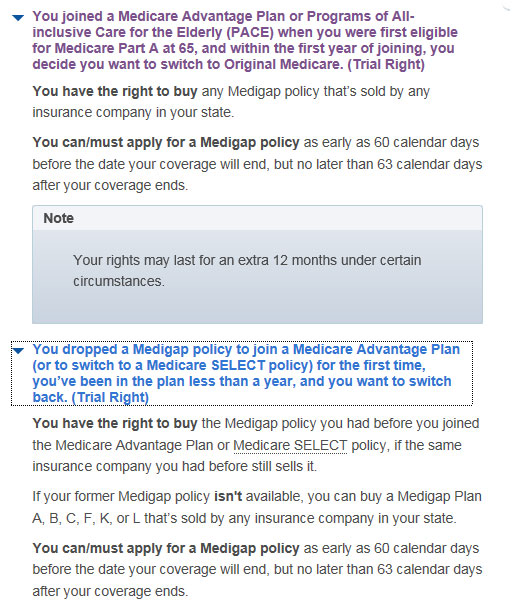

A. Yes. It is called the “trial right” period…there are very specific scenarios under which this applies – basically, movement from a Medicare Advantage plan to a Medigap during the “trial” period. It does not cover movement from one Medigap plan to another. I am adding the language from Medicare.gov for reference (see below). We should be cautious to share that this trial right is a universal truth because the scenarios are quite specific!

September 29, 2014

September 5, 2014

More Questions and Answers:

- Data Security? Data Sharing? I do NOT want to be solicited or receive any information, based on the fact that AON sold my name & address to another company. Our data privacy statement can be found on-line. We do not sell our data to third parties.

- Mobile APP for AON? No, AON will not have a mobile APP. If I am not at home and want to check status of a claim, etc. we will have to call their number. AT&T retirees will be the first to have access to the HRA mobile app which will be available as of January 1. The mobile app is called “reimburse me” and will become available after December 15, 2014 – assuming your enroll in a Medical and/or Prescription plan through the exchange. Our Advisors have not yet been trained on this application, but we will get the word out sooner than planned so the next time someone asks, they know it is coming.

- Company Couple? They did not ask, so I mentioned that my spouse is also a retiree. I was under the impression that the $2700 that I will get and the $2700 that my spouse will get can be used jointly. In other words if I my expenses exceed $2700, I could use some of my spouse’s dollars. While company couples each receive their own HRA account, they can share funds. What might be confusing is the concept of combining the 2 accounts into one, which is not necessary since each can utilize the others funds.

- Check claim status? Once we select a plan, starting 1/1/2015 can we view the YSA (“Your Savings Account”) tab on the AON website to see status of claims, dollars remaining etc. ? Yes, from the exchange site – you will connect to the YSA site to see claims data etc.

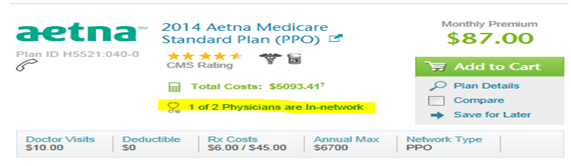

- Doctor Information? Since we are providing AON our doctor information, can we compare plans to see if our doctors are part of the plans? Several, but not all, plans provide Physician lists for searching. Only Medicare Advantage plans may require you to use specific doctors, so you will only see this feature available in those plans. Medigap plans are accepted by any Doctor that accepts Medicare, so there is no need to search for doctors that accept it. If you see them today, they accept Medicare. If a plan has provided a physician’s list – you will see an indicator for “Doctor Lookup”. Click on it to input all of your doctors. Once saved, you will see an indicator appear for each plan that will either tell you that the physician network is unavailable (the carrier does not publish the list) or how many physicians are included in that plan. I attached an example below:

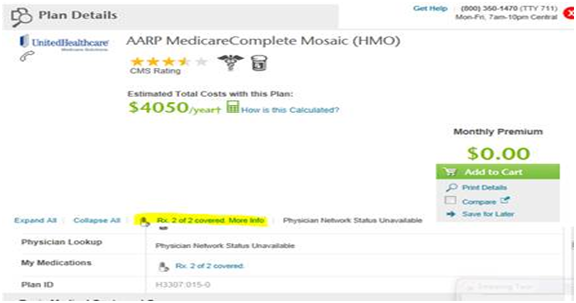

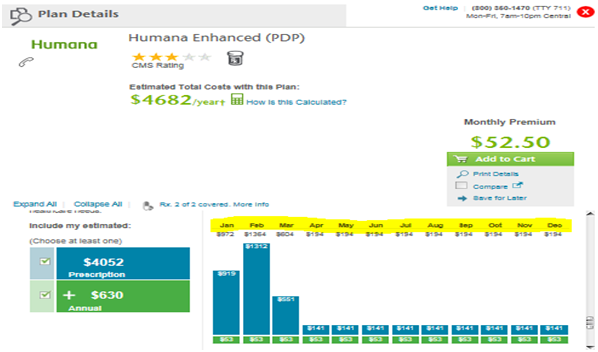

- Prescription Information? Will the website to allow me to search plans to see if my prescriptions are covered by each plan? While you cannot sort based on plans that cover your prescriptions, the site does indicate whether your prescriptions are covered in a given plan. You can also see this when you compare Rx plans. In a Medicare Advantage plan that includes prescription coverage and in the Prescription Plans (PDPs), you’ll find it in the details when you click on the plan:

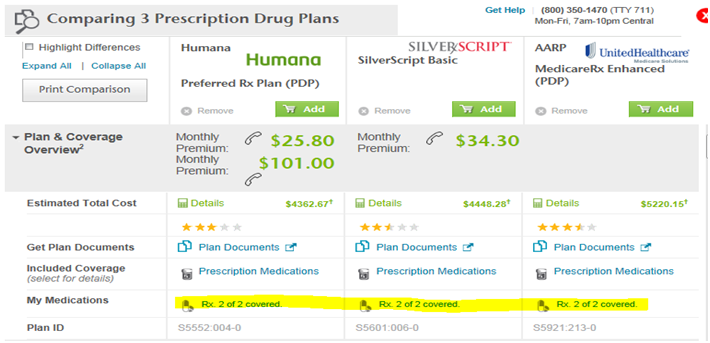

Another great place to see select plans side by side is in the plan comparison:

Another great place to see select plans side by side is in the plan comparison:

- When will estimates on monthly Rx costs be available? Monthly Rx costs can already be seen on-line in the details of each Rx plan. Double click on the plan you like and scroll to the bottom of the information provided where you can see estimated Rx costs by month.

- Care Plus? This will continue to be offered by ATT, but WILL NOT be part of AON. How will we sign up and pay for it? The retiree will be able to make changes to their CarePlus enrollment (enroll, disenroll, add dependent) during AT&T’s normal annual enrollment period. The retiree will receive information about annual enrollment during the fall timeframe.

- If the carrier has an OTC option can I pay the plan amount ONCE A YEAR then get fully reimbursed by AON? Yes, if someone pays a full year premium (allowable by a carrier), we would reimburse up to the available balance of the HRA.

- Dental & Vision? Plans are offered on website but we cannot compare side by side. Will this be available in the future? This is a potential enhancement for the future, but will not be in place in 2015.

- What is our coverage now? AON does not have details of our plans. Will this be available in the future? AT&T has provided the exchange with high level information about current plans. This information has been added to exchange accounts, including the name of the plan and high level features including copay, deductibles, out of pocket maximums, etc. The Advisors do not have access to Summary Plan Descriptions for each plan, nor can they provide details about specific conditions or procedures that might be covered under the current group health plan.

- Is AON pricing best? A health plan carrier is unable to offer pricing to any broker/seller of insurance that they do not also make available to any other broker/seller of insurance. Bottom line: When a retiree purchases individual Medicare insurance from a particular carrier, the price they will pay for that same insurance from that same carrier will be the same no matter who the broker/seller is.

On 9/5/2014 TelCo Retirees attended a Conference call with the AT&T/AON implementation

Team. Here are some of those highlights.

- Enrollment kits are being mailed out today through 9/10/2014. WATCH FOR THEM!!! When you receive your kit please make the call and confirm your appointment or go online and confirm.

- This is a “special” enrollment period for AT&T retirees. The normal enrollment period goes from Oct. 15 thru Dec. 15. This “special” enrollment period for AT&T retirees will go from Oct. 1, 2014 thru Dec. 31, 2014.

- What you can expect on the enrollment call from your healthcare advisor:

- You will probably be asked if you have chosen a provider or a plan. Most of us were told the advisors will assist us in making the best choice, but you should visit the website (www.retiree.aon.com/att) and thoroughly review the choices available in order to have some insight as to what is available.

- If you need assistance in making a choice your advisor will assist. Make a list of questions to ask prior to the call.

- For security reasons the advisor will ask for your name, address, and phone number…be prepared to answer because they are required to ask.

- You will be asked if there are any changes in the information you have provided on the website. (i.e. – Have your prescriptions changed)

- Your advisor will be able to advise you on the workings of the plan you have chosen and will, if necessary give you a chance to review your choices before you make a final decision. You may have to schedule an additional appointment.

- You may make a choice online without your advisor but you must then phone your advisor and let him/her know of your choice. This is a requirement to be actually enrolled. You and your spouse will be required to provide a voice signature of the plans you have decided upon…be prepared.

- Once you have enrolled, and should you not receive your providers ID card, call your advisor should you have to see a Dr.

Also on the call were representatives of the HR department, specifically the team responsible for the roll out of the retiree’s 30% discount on cell phone service. Highlights from that discussion are below:

- They are proud to be able to make this offer to their retirees in honor of the years of dedicated service.

- The 30% discount applies to voice and data plans.

- Also there is a 40% discount on certain accessories.

- Some fees are waived if purchased online.

- Important!! When you enrolled on line (www.att.com/dep) you will be asked to accept the terms outlined below. In case you didn’t bother to read that carefully you missed the fact that you have to sign up for paperless billing and you cannot pay your bill with a credit card!!!

- If you have difficulty enrolling for the discount you will need to call 1-888-722-1787 for assistance or send an email to hrplytmr@att.com. If you are still having trouble, let us here at TelCoretirees know. We’re here to help!!

August 13, 2014

A SUMMARY OF OUR CONFERENCE CALL AUG. 1, 2014 WITH AT&T/AON

(Note: These explanations apply only to those who will be moving to the AON/Hewitt Healthcare exchanges in 2015)

o Summary Plan Descriptions (SPD) for the new Health Reimbursement Accounts (HRA) to now be sent in October, 2014 in advance to enrollment.

o A new “HRA Guide” will also be sent to explain how to obtain reimbursement from AON, also to be sent in October time frame.

o AT&T will cover retiree/spouse for “Catastrophic Prescription Coverage.” The company will cover the premium with no cost to the retiree. Once the retiree/spouse exceeds $5,000 (each) during the year, the Plan will then cover the additional cost. As of now the retiree is to supply a copy of the Medicare Part D summary of annual expenses to AON for additional credits ($) to their Healthcare Reimbursement Account (HRA). Hopefully in the future this process can be made automatic.

o Upon the death of a retiree, their 65+ year old spouse will be credited with a onetime HRA supplement of $1,500. Pre-65 Medicare eligible spouses unchanged and subject to COBRA after normal extended coverage expires. (See Q&A #18)

o Recently sent SPD’s on Dental & Health went to all retirees. After December 31st, will only be applicable to anyone under 65, and not included in the AON Healthcare rollout, i.e. spouse, dependent.

o Coverage for all Medigap Alphabetic Plans (F, M, etc.) is alike per Federal Guidelines. Differences in price are due to competition or added embellishment features (i.e. hearing aids, etc.). AON has been requested to provide an on-line summary for clarification purposes

Additionally, below is a link to a video clip that will be helpful in understanding Medicare Part D and will aid your decision as to what plan to purchase & save on generic drug prescriptions.

There are two errors -

o Your premiums do not count toward the $2,850 pre-donut hole.

o The amount that goes towards the donut hole is still the “negotiated rate” not the manufactures suggested rate/price.

Otherwise in principal & theory the speaker is correct, as crazy & convoluted as it may sound! http://www.youtube.com/watch?v=UoXfMYSpiw0

Note:

Provided by John Tucciaronfe

Edited by Monte Baggs

August 5, 2014

August 1, 2014

Company Extended Coverage (CEC)

May 30, 2014

May 20, 2014

UPDATE ON AT&T/Aon HEALTHCARE EXCHANGE MEETING IN OAKLAND, CA.

My wife, Phillis, and I attended the afternoon meeting in Oakland yesterday and gleaned a great deal of information from the session that I wanted to share with all of you.

Marty Webb, Vice President of Benefits hosted the meeting and did a great job of explaining why AT&T decided to make the move to the “Exchange” environment at this time. Contrary to rumor, it was not due to the Affordable Healthcare Act (Obama Care) as has been rumored. He explained that since the Exchanges have been in place for around ten years now they have matured and are now very competitive with the prices AT&T has been able negotiate on their own in the open market place. He explained that they have been assessing this move for a number of years and decided that, given the new competitive environment and the added flexibility it gives retirees, 2015 is the right time to make the move to the Aon/Hewitt Exchange environment. Marty also explained that they were very deliberate in the selection of Aon/Hewitt as the company to administer the plan. He said they evaluated several others but decided on Aon/Hewitt because they gave the necessary assurances that they would deliver a product that is specific to the needs of AT&T retirees. Specifically, they would design a delivery system that took into consideration the fact that most of us (AT&T retirees) have never had to negotiate or shop for healthcare insurance and would be completely unfamiliar with the process. Thus, they agreed to have Benefit Advisors available for each retiree throughout the entire selection and enrollment process. These are specially trained, insurance brokers for each area of the country. They are salaried so they have no incentive to do anything but seek the best match for the needs of the retiree and the same Benefits Advisor will be available to the retiree throughout the entire process. Aon/Hewitt also agreed to start the transition process much earlier than most other major companies have done in order to assure that each retiree had ample time and information to make an informed decision.

One final and very reassuring note that Marty passed on was that he and the rest of the senior executive staff of AT&T are very committed to the retiree population and have no desire to walk away from the committed benefits plans in the future.

The Aon/Hewitt representative presented a very detailed description of how Medicare Parts A, B, C and D works and how Medicare Supplement and Medicare Advantage plans work in conjunction with Medicare. All this information will be available in the Educational Kits which are being sent out currently. Here’s a key checklist:

- Receive and read the Educational Kit!

- Confirm the Education Appointment with your Benefits Advisor!

- Gather your Prescription drug and Dr. information!

- Register online at retiree.aon.com/att (optional)

- Add drug information!

- Attend Education Appointment with Benefits Advisor – July through Sept.

- Enroll in plan(s) – Oct. 1 through Dec. 31, 2014!!!

QUESTIONS CALL Aon Retiree Health Exchange 1-800-928-8027

Monte Baggs, Vice President, TelCo Retirees Association

May 7, 2014

HIGHLIGHTS OF THE MEETING WITH MARTY WEBB, AT&T VICE PRESIDENT – BENEFITS

AT&T ANNUAL MEETING – COLUMBUS, GA.

FRIDAY 4/24/2014

Question – What is the status of the move of Medicare eligible retirees to the Aon-Hewitt medical exchanges?

Answer – The moves are progressing on schedule. The initial information packages are being sent out as we speak and should be in the hands of all retirees within days from now. Retirees should review these packages thoroughly. Meetings are being scheduled in many cities across the country for retirees to get detailed information for their individual situations. Supplemental Webinars are also scheduled for those unable to travel to the meetings. Every retiree should plan to make one or the other of these meetings! See the attachment for details of the meeting locations and dates (See pg.16).

Monte Baggs Marty Webb Chuck Gilbert

April 24, 2014 – Columbus, Ga.

Randall Stephenson, Chairman, AT&T Board of Directors

2014 AT&T Annual Meeting – Columbus, Ga

Monte Baggs, Vice President, TelCo Retirees Association.